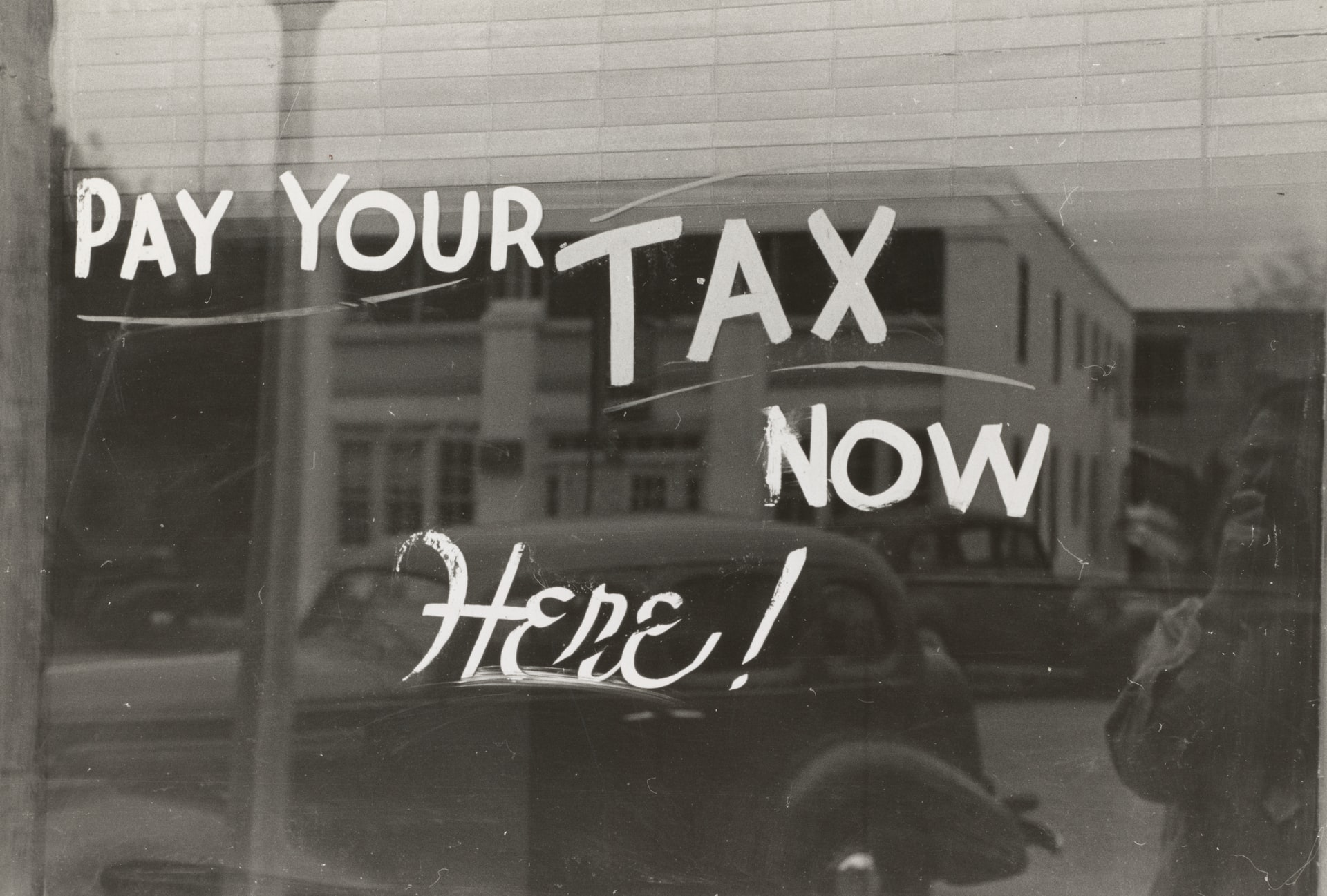

Maybe you see a way to standout from competitors by offering tax preparation services, maybe you see a way to grow revenue, and maybe you feel tax preparation services are an easy add-on service. Whatever your reason, read this article before you include tax return preparation services.

Is your RIA firm thinking about offering tax return preparation to your clients? The Elevate CPA Group and its sister firms have been providing tax services for over half a century combined. We understand the pros and cons of a tax preparation business and before reading on, we suggest you watch this short video.

For tax accountants, this video is hilarious (let’s face it, accounting humor is rarely widely accepted as funny) mainly because it is true. Here are some items to consider before starting a tax preparation service for your clients.

1) Your Tax Team: Who and How Many?

Tax professionals are in high demand, especially experienced tax preparers. Keeping a tax professional is also difficult due to a shortage and strong competition. Your services will be very contingent on this person. How big will your tax team be? Tax returns are complicated. Most tax firms use a review process to make sure to check work for accuracy. Who is going to be that reviewer for your tax returns? I personally only file my own return without review, every other return I work on is reviewed and most of the time, there are changes to be made. I have survived 25 busy seasons and still need and want my work to be double checked.

2) Your Firm’s Approach to Tax Compliance

Ask yourself these questions:

- Does your firm take a conservative by the book approach?

- Does your firm take aggressive positions?

- Does your tax team share this same approach and who is monitoring them?

- When the returns are viewed by 3rd parties or the IRS, are you comfortable with the quality of the product?

Our firm has an opportunity to see other firms’ work when meeting with a potential new client. A surprising amount of the returns we see have easily identified errors or missed opportunities. Some clients are unaware of aggressive or incorrect positions taken on their return. Will this lead to you losing an investment client due to bad tax work discovered by others?

3) Deadlines and Clients Who Just Don’t Care About Them!

Significant time and effort is spent by tax preparers collecting all the relevant tax documents and questions for tax return preparation. The most difficult part is getting clients to respond and send you the info. Imagine it is April 1st and you ask a client for a 1098 Mortgage Interest Statement. What goes through the client’s mind?

- What the hell is a 1098 and where do I find it?

- Taxes, I HATE taxes.

- Why do they need this?

- It is only April 1st; the deadline is in two weeks. I will get it next week to them (and likely forget about it).

Now, imagine this multiplied by the number of clients you are preparing tax returns for! The result is a stressful deadline with long hours for your team. Clients are often frustrated with the last-minute nature because…

4) Tax Returns Are a Grudge Purchase!

None of us would voluntarily complete tax returns! Rarely can someone prepare their own return if they have investments correctly. Clients are faced with paying money for a service they don’t really want. This is far different from the value proposition you bring as an investment advisor.

5) The Economics of a Tax Practice

The backbone of a profitable tax practice often lies with the efforts of the owners. Yes, tax practices make some money off the team, but a significant portion of the profit comes from the efforts and hours billed by the owners. Programs and resources can be costly. You need a good tax preparation program and a good tax research program at a minimum. There is also licensing continuing education and insurance.

Now, re-watch the video. Pretty funny right?

Running a successful business is hard work whether it is an RIA firm or a tax preparation firm. At Elevate CPA Group, we believe your firm has unlocked value and potential. We help RIAs unlock that potential and focus the owners on enhancing the value of their business. Make sure you are unlocking the value of your core business before chasing ancillary services. Contact us to start the process of unlocking the true value of your business.

Still want to offer tax services to your clients?

Elevate CPA Group has heard from a number of RIA firms requesting tax preparation and return services. In response, we have launched Elevate RIA Tax Solutions (ERTS) to a select few firms and will be rolling out this offering nationwide in 2023. If you’re interested in ERTS, please contact us. In the meantime, you can learn more about ERTS here.